Self-Insured Consulting

Consulting

PATH provides consulting services for companies and groups who are or want to become self-insured. Our expertise enables us to provide strategic advice to address complex risk management and regulatory issues and deliver value-added solutions. We also can assist with the implementation and execution of the solutions developed. Our consulting services fall into three primary areas, self-insurance, regulatory compliance, and risk management.

self-insurance

Value and results delivered through expertise.

PATH offers expert guidance for companies considering or already self-insured, leveraging our extensive experience to maximize your bottom line. Whether you’re starting out or optimizing your program, we’re here to help you succeed.

- Self-Insurance Program Administration

- Implementation Feasibility Studies

- Performance and Claims Optimization

- Outsourced Program Management

- Program Cost Reduction

- Claims Oversight and Planning

- Turnaround and Work-Out Plans

Regulatory Compliance

Complex regulatory issues made understandable and solved.

Self-insurance regulations are complex. PATH can clarify the issue and recommend effective and expedient solutions.

- State Regulator Relations

- Regulatory Issues Resolution

- Collateral Requirement Planning

- Compliance Risk Assessment

- Compliance Plan Development

- Compliance Plan Monitoring

risk management

Strategic Risk Consulting resulting in Risk Intelligent Decision Making

PATH offers specialized expertise to enhance your workers’ comp program by identifying, assessing, and mitigating risks. Our tailored strategies and best practices safeguard your assets, improve decision-making, and boost operational efficiency, giving you a competitive edge.

- Enterprise Risk Management (ERM)

- Program Review and Risk Analysis

- Risk Transfer Strategies

- Governance, Risk and Compliance

- Total Cost of Risk (TCOR) Reduction

- Strategic and Operational Risk Management

why should you choose path

Our in-house experts provide impressive background, experience, and capabilities.

-

- Our team of experts deliver Risk Intelligent Decision Making

- Possess deep regulatory knowledge and expertise

- Experienced in developing feasibility studies to evaluate self-insurance

- Skilled with complex forecasting, collateral planning, and turnaround situations

- Financial and claims analytics and modeling for cost reduction and planning

- Business intelligence, data analytics, analysis and reporting

- Experienced with Fortune 500 to family-owned enterprises, and governmental entities

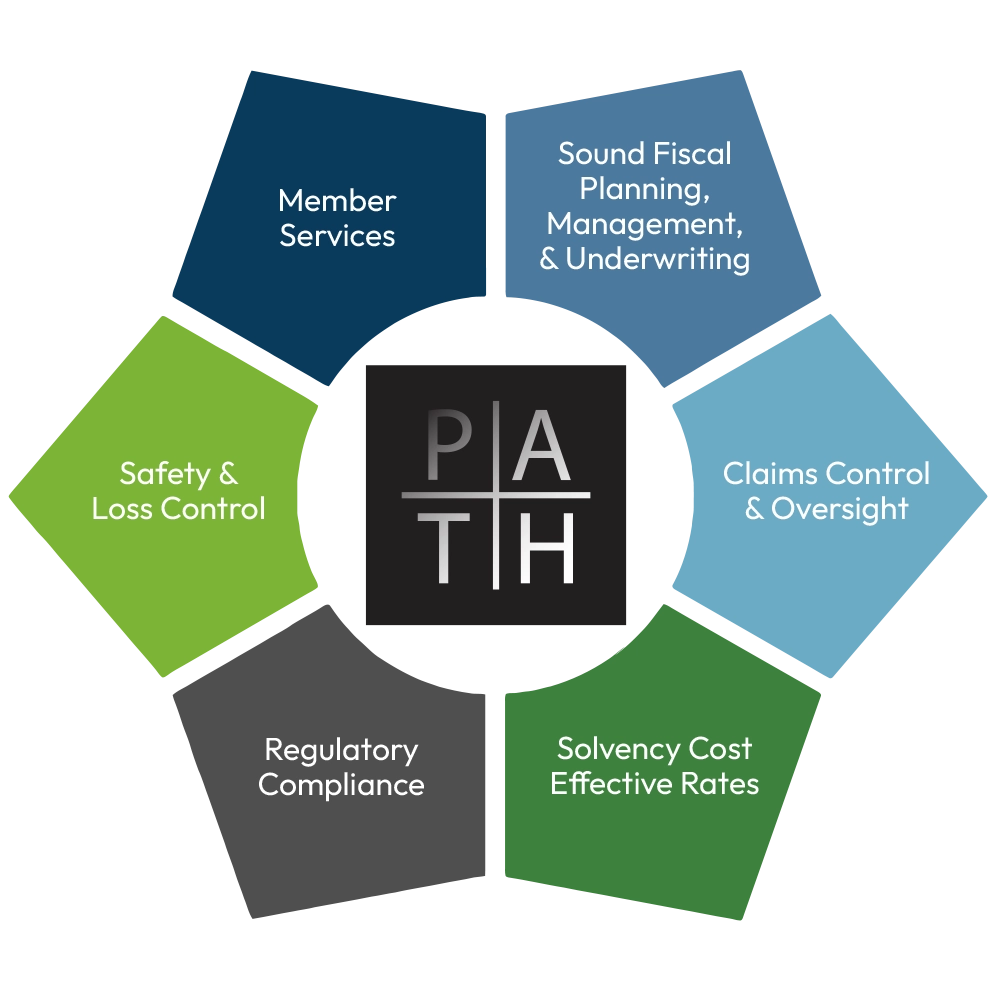

the path philosophy

The Confidence of a Comprehensive Approach

PATH takes a 360-degree view bringing together the elements of your risk management, self-insurance, and workers’ compensation programs. This integrated approach provides our clients with the peace-of-mind that they have effectively and efficiently mitigated their risk profile.

THE PATH ALLIANCE

Unlock your company's potential and gain a competitive edge.

Partner with PATH today to navigate self-insurance and risk management with expert guidance tailored to your needs!